Empowering the Underserved

Addressing the Credit Invisible Challenge

In 2025, fintech innovations are transforming financial inclusion for the “credit invisible”—an estimated 26 million US adults and billions globally who lack traditional credit histories. These individuals, often young, low-income, or in emerging markets, are excluded from conventional financial systems. Fintech platforms are leveraging alternative data and technology to provide access to credit, fostering economic empowerment and opportunity.

Alternative Data Drives Inclusion

Redefining Creditworthiness

Fintech companies are using non-traditional data—such as utility payments, rent, and mobile app usage—to assess creditworthiness for those without credit scores. Platforms like Tala and Petal analyze behavioral patterns to offer microloans or credit cards, enabling credit invisibles to build financial profiles. This approach unlocks access to loans, supporting small businesses and personal growth in underserved communities.

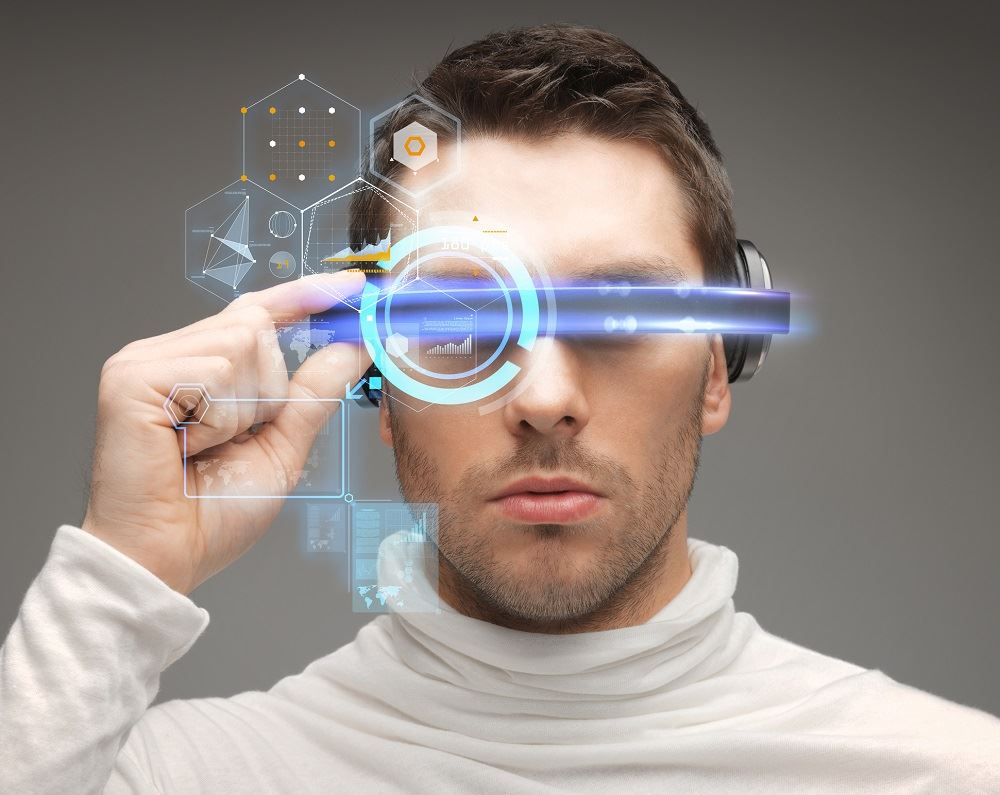

AI and Machine Learning Innovations

Personalizing Financial Solutions

Artificial intelligence and machine learning are at the core of fintech’s push for inclusion, enabling precise risk assessments for credit invisible consumers. By processing vast datasets, AI-driven platforms like Upstart create tailored loan products, reducing default risks while expanding access. These technologies ensure fairer lending practices, helping marginalized groups secure financing without relying on traditional credit bureaus.

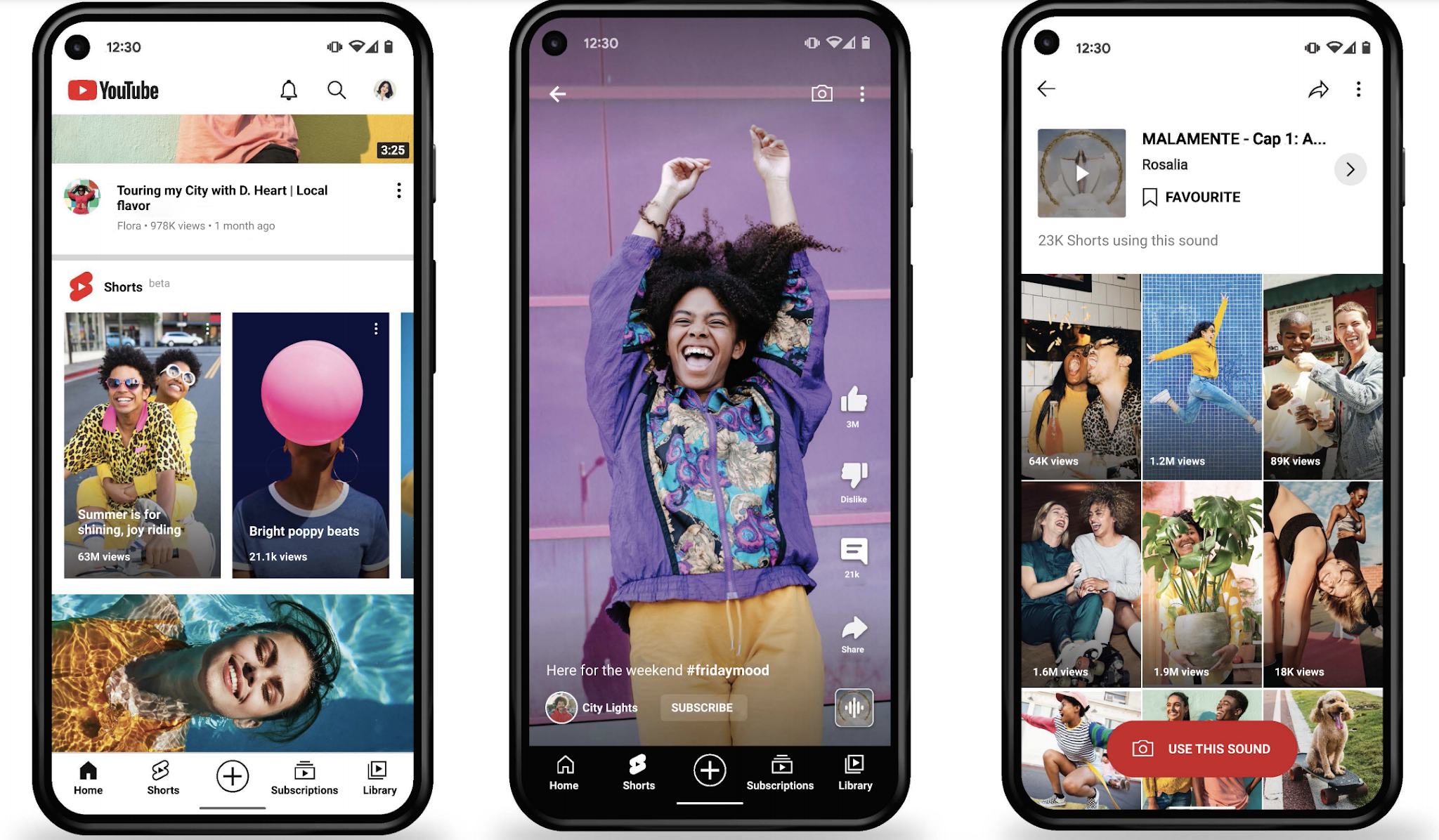

Mobile Banking Expands Reach

Bringing Services to Remote Areas

Mobile-first fintech solutions, such as M-Pesa and Chime, are bridging gaps for credit invisible populations in rural or underserved regions. With over 80% of global adults owning smartphones in 2025, mobile apps offer instant access to banking, savings, and credit-building tools. This accessibility empowers users to manage finances, fostering inclusion in areas where traditional banks are scarce.

RegulatoryArtefacts Regulatory Hurdles Persist

Balancing Innovation and Compliance

While fintech drives inclusion, navigating fragmented regulations remains a challenge. Varying data privacy laws, like GDPR in Europe or CCPA in the US, complicate the use of alternative data. Fintech firms must ensure compliance while scaling solutions for credit invisibles, partnering with regulators to create frameworks that protect consumers without stifling innovation.

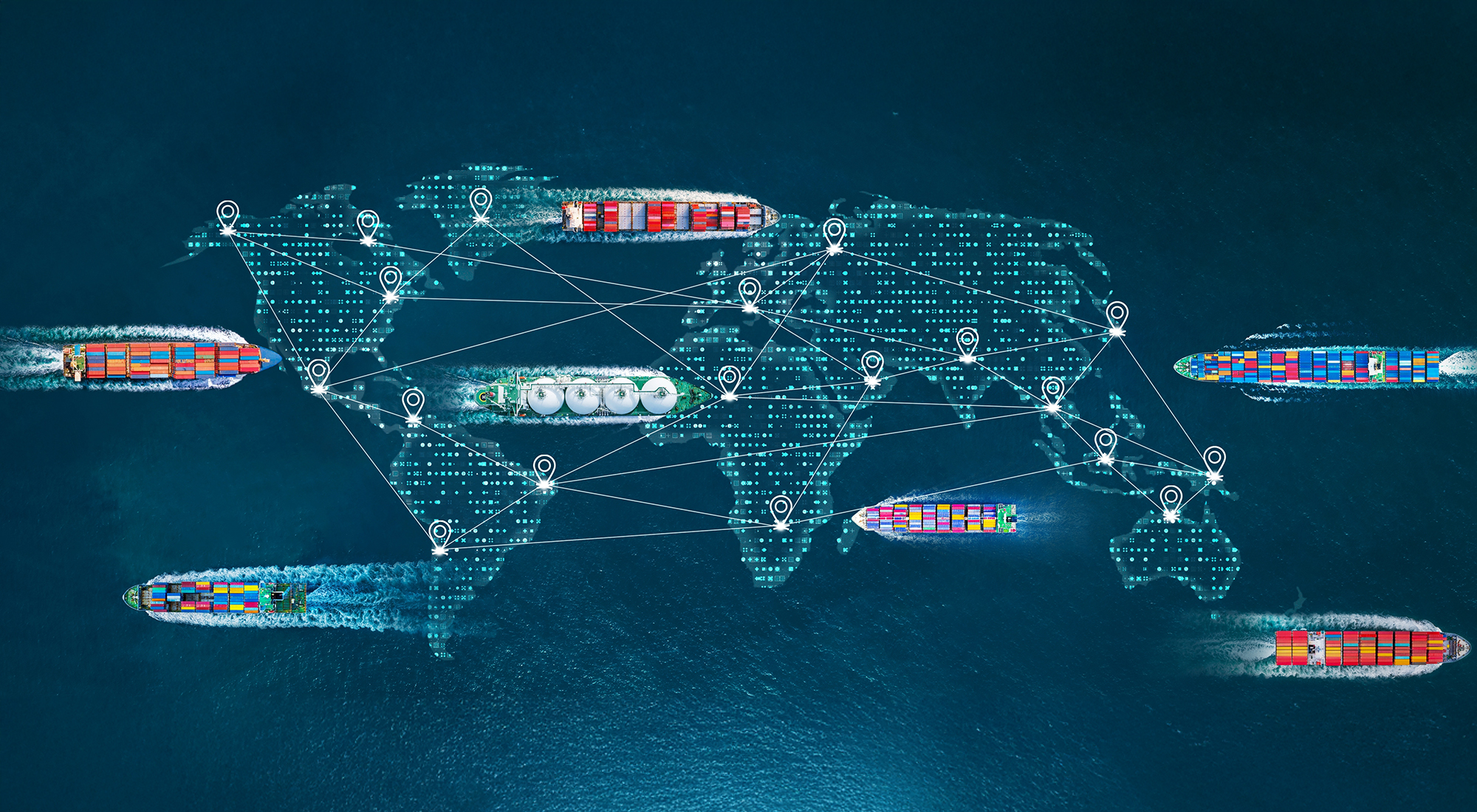

Building Financial Futures

Long-Term Impact of Inclusion

Fintech’s efforts to serve credit invisible consumers are reshaping economies by enabling access to credit for entrepreneurship, education, and homeownership. By integrating blockchain for secure transactions or AI for scalable lending, these platforms are creating sustainable financial pathways. As inclusion grows, credit invisibles are gaining the tools to build stronger financial futures, driving global economic equity.